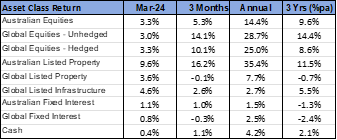

– March Market Snapshot –

- Global equity markets posted further gains over March, with sector leadership switching to property and materials.

- Bond yields fell slightly, reversing some of the increase of the previous two months.

- The Australian dollar was firmer despite further weakness in the iron ore price.

International Equities

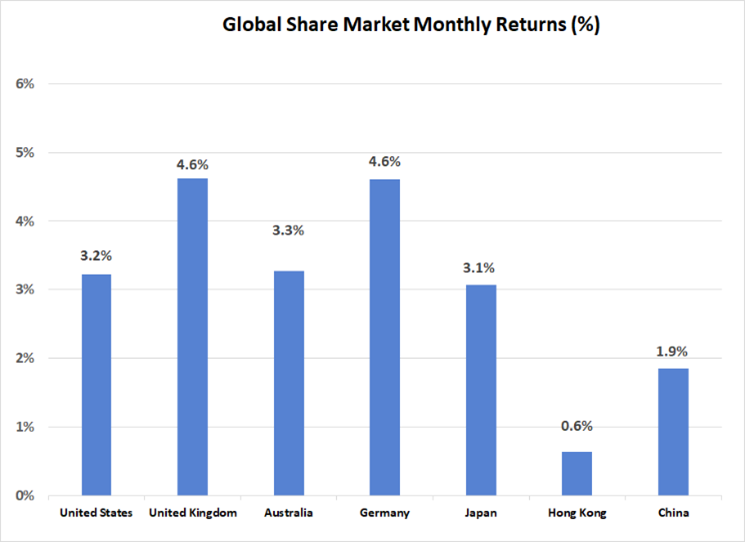

Gains across global equity markets were consistent in the 3% to 5% range over March. New record highs were set in several markets, with the average annual gain in the asset class now 25.0%. However, in contrast to the dominant trend of recent months, the Technology sector underperformed the market average – albeit returns in the sector were still slightly positive. The more “value” orientated sectors performed better last month, with higher energy and commodity prices also boosting resource and energy stocks. The U.K market (up 4.6%) outperformed and was a beneficiary of the higher energy prices. The pattern of price gain across global equity markets last month may suggest investors were searching for value in areas that had not participated as strongly in the rally of the past year. An outperformance from smaller companies during March was consistent with this pattern.

Of note last month were large movements in commodity prices. A range of base metal prices strengthened, with the RBA Base Metal Commodity Index rising 3.2% in $US terms. Oil prices were 6.3% higher, with gold also rallying 8.1%. In contrast, commodities associated with steel making were weaker. Coking coal prices dropped by more than 20%, while a 15.2% fall in the iron ore price brought the decline this calendar year to 30.3%.

Following a significant bounce in February, the Chinese share market consolidated its gains during March, rising by a further 1.9%. Both the share market and the broader Chinese economy may have now passed the bottom of recent downturns, and the relatively cheap valuations on the Chinese equity market have been attracting some buying support. On an annual basis, the Chinese equity market remains in negative territory by 9.4%, with the Hong Kong market 15.7% lower. Outside of China, other emerging markets were mixed last month. India (up 1.4%) underperformed the broader global average, as did Brazil (down 1.8%), which was impacted by the lower iron ore price. There were, however, strong performances from South Korea (up 5.6%) and Taiwan (up 7.9%).

Following a period of underperformance, both global property and infrastructure slightly outperformed equity markets more broadly with gains of 3.6% and 4.6% respectively. A small reduction in longer term bond yields is likely to have prompted some support for these sectors, which had become cheaper relative to other listed assets over recent months.

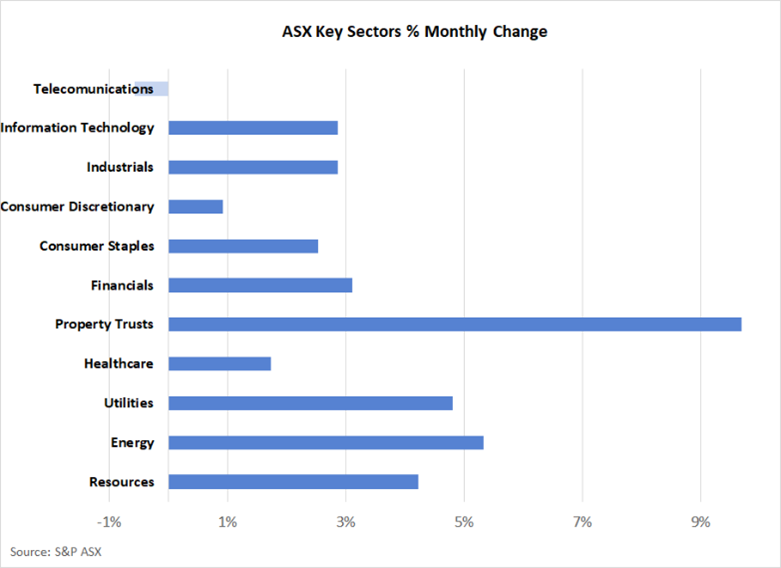

Australian Equities

The Australian share market moved in line with the global average last month, with the S&P ASX 200 Index rising by 3.3%. Listed property was the best performing sector and was again boosted by Goodman Group, which rallied 13.1%. Assisted by a positive outlook for data centre demand, Goodman has increased by 82.4% over the past year and now represents 35% of the value of the S&P/ASX 300 A-REIT Index.

Despite the lower iron ore price, the resource sector still performed well last month. Both BHP (up 3.3%) and Rio Tinto (up 1.6%) increased in value and reversed some of the previous month’s decline. This reversal is perhaps an acknowledgement that both companies can maintain healthy profit margins even at lower iron ore price levels.

Only the Telecommunications sector recorded a negative result, with Aussie Broadband’s decline of 21.3% being a major contributor to this.

Fixed Interest & Currencies

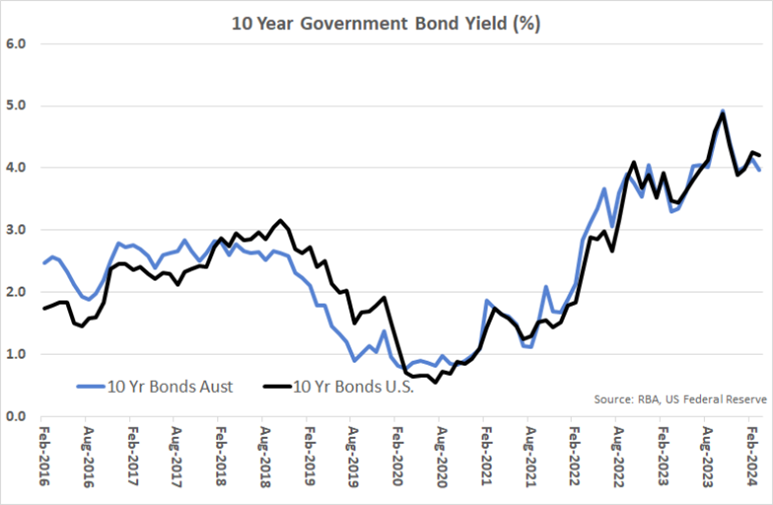

There were some minor changes in monetary policy settings during March, with the Swiss central bank lowering interest rates by 0.25% and the Bank of Japan increasing its policy rate to just above zero. However, policy settings in Australia and the United States remained unchanged. The Minutes of the Australian Reserve Bank’s March meeting did indicate a slight change in tone with the Bank noting that “incoming data had not indicated a materialisation of upside risks to inflation and growth in output had slowed as expected”. This change in tone possibly suggests a higher willingness to lower interest rates should inflation continue to decline.

Longer term bond yields were slightly lower over the month, creating small capital gains for fixed interest investors. The U.S. 10-year Treasury Bond yield fell from 4.25% to 4.21%, with the Australian counterpart dropping from 4.14% to 3.96%. The 0.25% margin between the U.S. and Australian 10-year yields is the largest recorded on a month end basis since October 2022 and is indicative of the weaker economic growth outlook for Australia.

Currency markets were little changed over the month. The $A firmed slightly against the $US, rising from U.S. 65.2 cents to U.S. 65.3 cents, and was also slightly stronger against the Euro (up 0.3%) and Yen (up 1.2%).

Outlook and Portfolio Positioning

The rally across global equity markets in the March quarter was noteworthy given that it followed such a substantial increase in the final two months of last year. Five consecutive monthly increases on global equity markets have resulted in valuations advancing a significant 23.6%. The justification for an increase of this magnitude is twofold. Firstly, there was clear evidence that inflation was being brought under control, which allowed the U.S. Federal Reserve to indicate that interest rates would fall this year without the U.S. economy having to experience a significant downturn or recession. Secondly, company earnings have been healthy, particularly in the U.S. technology sector, with the promise that significant advances in Artificial Intelligence (AI) could provide a springboard for further structural improvements in profitability, productivity and ultimately living standards.

A key feature of the equity market rally over recent months has been its narrowness. Technology stocks inside the U.S. S&P 100 Index gained 31.6% since the start of November and are nearly 50% ahead for the past year. This is approximately double the annual gain in the global equity market as a whole. No doubt some of this disproportionate increase can be explained by the favourable profit results announced by companies in this sector, and the fact that many are well positioned to benefit from AI. However, history does suggest that financial markets can “over extrapolate” new information and operate with “irrational exuberance”. Only time will tell whether or not now is one of those occasions.

Given the valuation risks that have potentially emerged in the technology sector, the change in the pattern of price growth evident in the final month of the March quarter was welcome. Areas of the market that had been ignored for much of the past year, such as infrastructure, smaller companies and property (where Goodman has been one of the few property companies globally to attract any positive sentiment) showed strong buying support and outperformance. This more balanced pattern of price movement, though, could be a sign that the equity rally is reaching a mature phase of the cycle whereby investors are being forced to look wide and hard for the remaining pockets of value.

The other welcome development that has emerged more recently has been a rebound in the Chinese equity market. Whilst still well off its past highs, two consecutive months of price growth may play an important role in restoring confidence to Chinese financial markets and businesses. Economic data in China is showing some sign of improvement, with the release of monthly manufacturing activity last month confirming the first monthly increase for 5 months. As the world’s second largest economy, the significance of any improvement in Chinese economic growth should not be understated.

Due to the magnitude of the rally that has taken place in the U.S. technology sector over the past year, many investment portfolios would be heavily weighted to a relatively small number of companies in this sector simply because of market movements. Similarly, exposure to the US currency may also be extended. Because of the narrowness of the equity market rally, deliberate actions to diversify into areas such as infrastructure, emerging markets and mid to smaller companies are now more important than ever. The month of March, whereby market leadership was provided by sectors other than Information Technology, may not be a short-term aberration.

Important Information

The following indexes are used to report asset class performance: ASX S&P 200 Index, MSCI World Index ex Australia net AUD TR, MSCI World ex Australia NR Hdg AUD, FTSE EPRA/NAREIT Developed REITs Index Net TRI AUD Hedged, Bloomberg AusBond Composite 0 Yr Index, Barclays Global Aggregate ($A Hedged), Bloomberg AusBond Bank Bill Index, S&P ASX 300 A-REIT (Sector) TR Index AUD, S&P Global Infrastructure NR Index (AUD Hedged), CSI China Securities 300 TR in CN, Deutsche Borse DAX 30 Performance TR in EU. Hang Seng TR in HKD, MSCI United Kingdom TR in GBP, Nikkei 225 in JPY, S&P 500 TR in USD.

General Advice Disclaimer

Any advice contained in this document is of a general nature only and does not take in to account the objectives, financial situation or needs of any particular person. Any decision to invest in products mentioned in this document should only be made after reviewing the relevant Product Disclosure Statements. Past performance is not a reliable indicator of future performance. Varria Pty Ltd is an authorised representative of Charter Financial Planning ABN 35 002 976 294 AFSL number 234665