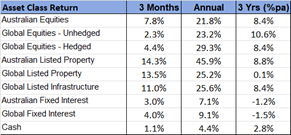

– September Market Snapshot –

- Evidence of lower inflation allowed the US Federal Reserve to cut cash interest rates by 0.5%, with longer term bond yields continuing to decline.

- Chinese equities and global commodity prices bounced back strongly late in the quarter, following a range of new Chinese policy stimulus measures.

- Share markets shrugged off a sharp correction in early August to finish the quarter well ahead.

International Equities

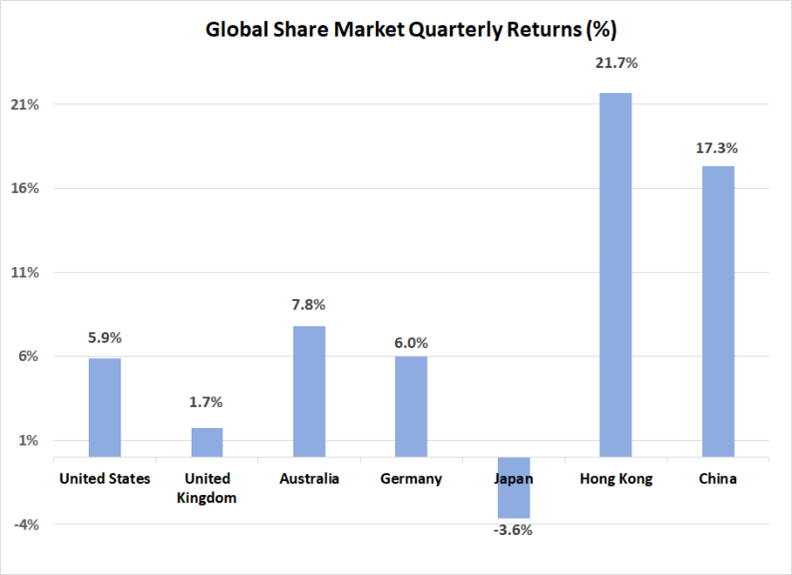

After declining by 6.6% in the first 3 trading days of August, global equity markets bounced back strongly to finish the quarter 4.4% higher on average. It appears technical market factors were the predominant driver of the early August correction. More specifically, the Bank of Japan’s announcement of an increase in the overnight cash interest rate (to approximately 0.25%), and its intention to be less supportive in buying government bonds, was significant.

Also showing a shift in sentiment over the quarter was the U.S. share market, where there was a period of concern over the prospect of slower economic growth, but this was quickly replaced by optimism around the likelihood the Federal Reserve would cut interest rates. The U.S. S&P 500 Index rose 5.9% over the quarter. Whereas “growth” and technology stocks have been the primary source of gain for global share markets over the past two years, the advance on share markets was more balanced last quarter, with “value” styled, cyclical stocks and smaller companies participating strongly in the rally.

China became the focus of global equity markets in late September, after authorities announced a range of new measures aimed at stimulating the domestic economy and supporting the local share market. Following an extended period of underperformance, the Chinese share market finished the quarter 17.3% higher, with Hong Kong gaining 21.7%. The well received policy measures included a 0.5% reduction in the Reserve Requirement Ratio, which will allow banks to increase their volume of loan activity. In addition, mortgage interest rates applying to existing loans have been reduced by an average of 0.5%, thereby creating greater capacity for households to spend. Equity markets are also expected to benefit from new financing being made available to companies for share buybacks, as well as a stabilisation fund being created to support share market valuations when needed.

The ongoing decline in bond yields was highly supportive of real assets. Global listed property (up 13.5%) and infrastructure (up 11.0%) built on recent gains. Australian listed property was particularly buoyant, with a 14.3% increase applying broadly across the wider asset class, with the largest constituent, Goodman Group, gaining a less impressive 6.5%.

Australian Equities

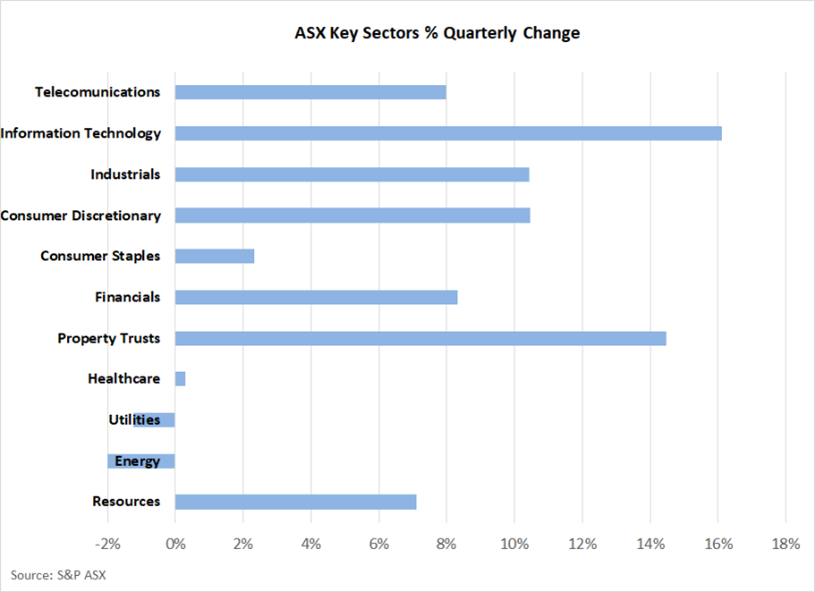

The Australian share market outperformed the global average, with the S&P ASX 200 Index rising 7.8% over the 3 months to September. For most of the quarter, the market was led higher by very strong support for the banking sector. In contrast, weakening iron ore prices weighed heavily on resource stocks for much of the period before the Chinese stimulus prompted a turnaround in both commodity prices and mining shares. The financial sector finished the quarter 8.3% higher, with resource stocks up 7.1%.

Although much smaller in size, the technology sector was the best performed on the Australian market last quarter, rising by 16.1%. The sector benefited from some positive company earnings results, with Wisetech being the standout with a 36.9% price increase.

Fixed Interest & Currencies

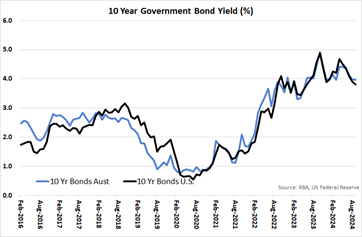

The focus of bond markets over the quarter was clearly centred on the U.S. central bank, as confirmation of lower inflation created the scope for interest rates to be cut. With the Federal Reserve ultimately opting for the larger 0.5% reduction in the cash rate, interest rates were dragged lower across the yield curve. U.S. 10-year treasury bond yields dropped by 0.55% to 3.81%. This suggests that the money market anticipates a series of further cash rate reductions from the current level of 4.8%.

With the Australian Reserve Bank (RBA) being one of the few developed economy central banks to keep policy unchanged over recent months, there has been less movement in rates across the Australian yield curve. None-the-less, the 10-year Australian government bond yield did fall 0.39% to 3.96% last quarter, with some evidence of lower inflation contained in the latest monthly indicator numbers for August. However, Australian labour markets remain strong, with unemployment at 4.2% removing any urgency for the RBA to cut interest rates before securing sustained lower inflation.

After declining for much of 2024, the $A appreciated against the $US last quarter, rising from US 66.2 cents to US 69.3 cents. Support for the $A was driven by the decline in interest rates in the U.S.; as well as the Chinese policy stimulus, which was viewed as being positive for Australia’s trade position. The $A was also 0.2% higher against the Euro but declined 7.9% against the Japanese Yen.

Outlook and Portfolio Positioning

Equity market sentiment received another boost in September, with policy stimulus from both the US central bank and Chinese authorities being a catalyst for another wave of investor optimism. Upward momentum on global share markets has been substantial, with equities moving higher in 10 out of the last 11 months. One year ago, investors appeared deeply concerned about the prospect of a global recession. Today, the global share market is 29% higher.

Although the growth in share market valuations can be justified by the healthy state of company earnings, periods of investor exuberance should call for a more critical risk assessment than would normally be the case. Uncertainty over the course of the US election, and the possible further deterioration of the situation in the Middle East, are two recognisable sources of risk. Market reaction to date implies the consensus view is that these risks are unlikely to have a long-lasting impact on the broader global economy or company earnings. However, investor sentiment can be fickle, and the potential implications of these events may start to erode investor conviction, particularly as the election looms closer.

Bond markets, of late, have shared in the wave of investor optimism. This investor confidence has driven a downward adjustment to bond yields. However, this fall in yields presents another risk to financial markets. Underpinning a 0.9% reduction in the U.S. 10-year Treasury Bond yield over the past 5 months (to 3.8%) is a belief that the fight against inflation has been won. Assuming an eventual return to a normal upward sloping yield curve, current bond market pricing implies a US cash rate around the 3% level. This requires the Federal Reserve to reduce the cash rate by another 2%, which will only occur if inflation continues to track towards a long-term average of 2% to 2.25%, or lower; or if there is a significant deterioration in the economic outlook. It could be argued, therefore, that bond markets are “priced to perfection” in terms of the inflation path. Any deviation from this path would challenge current yield settings, which would have negative implications for equity market pricing. Hence, the recent spike in oil prices and uplift in key commodity prices, should serve as a note of caution for investors.

Given the risks outlined above, and the degree to which equity markets have appreciated over recent quarters, it may be appropriate for investors to lock in some profits and at least bring growth asset exposures back to a neutral position. Notwithstanding the need for caution, current market optimism and consensus may ultimately be proved correct, as some of the risks highlighted may be short term in nature. Broadly speaking, the global economy, the financial system and corporations generally, continue to function well and are supportive of increasing returns to shareholders. However, history does suggest that the time to be most cautious should often be when others are most optimistic – and optimism has been the most dominant sentiment on financial markets in recent times.

Important Information

The following indexes are used to report asset class performance: ASX S&P 200 Index, MSCI World Index ex Australia net AUD TR, MSCI World ex Australia NR Hdg AUD, FTSE EPRA/NAREIT Developed REITs Index Net TRI AUD Hedged, Bloomberg AusBond Composite 0 Yr Index, Barclays Global Aggregate ($A Hedged), Bloomberg AusBond Bank Bill Index, S&P ASX 300 A-REIT (Sector) TR Index AUD, S&P Global Infrastructure NR Index (AUD Hedged), CSI China Securities 300 TR in CN, Deutsche Borse DAX 30 Performance TR in EU. Hang Seng TR in HKD, MSCI United Kingdom TR in GBP, Nikkei 225 in JPY, S&P 500 TR in USD.

General Advice Disclaimer

Any advice contained in this document is of a general nature only and does not take in to account the objectives, financial situation or needs of any particular person. Any decision to invest in products mentioned in this document should only be made after reviewing the relevant Product Disclosure Statements. Past performance is not a reliable indicator of future performance. Varria Pty Ltd is an authorised representative of Charter Financial Planning ABN 35 002 976 294 AFSL number 234665